Why Americans Are Carrying Less Credit Card Debt

It’s no surprise that Americans lost overall wealth during the Great Recession. Jobs were harder to come by, investments faltered and housing prices stagnated. Though we are now on the upswing, the downturn affected how consumers make purchasing decisions, from buying fewer luxury goods to taking out fewer loans. A recent Federal Reserve study showed another surprising change in behavior: Americans are reducing their credit card debt.

How the Great Recession Affected Americans

The Federal study on the effects of the Great Recession showed that median family income fell by 7.7 percent between 2007 and 2010, with median family net worth falling 38.8 percent in the same time-frame. While some people came out unscathed, beneath these numbers are countless foreclosures, bankruptcies and failed family businesses. It seems this would create an incentive to borrow on credit cards, but the study showed just the opposite: a 16.1 percent drop in the median balance on credit card accounts.

Americans Cutting Credit Card Debt

In 2007 roughly 46 percent of American families had an average credit card debt of $3,100. By the end of 2010, 39.4 percent of families were carrying a median balance of $2,600. According to the Fed study, “the decreased prevalence of credit card debt outstanding was widespread and noticeable across most of the demographic groups.” This means just about everyone was reducing his or her credit card debt. The instability of the economy, with many either out of a job or uncertain about the future, has made a lot of consumers wary about racking up debt on their credit cards.

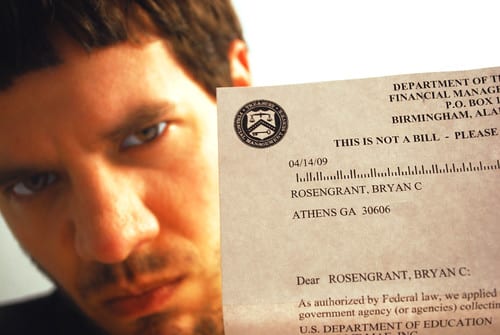

Bankruptcy Filings and Careful Lenders

The reduction in credit card debt comes, in part, from careful consumer choices. But the truth is that the Great Recession spurned an incredible number of bankruptcy filings. Prior to 2007 when the economy took a tumble, Americans were piling up debt with lenders. Many lost their jobs and found themselves faced with bankruptcy to get out from under their home mortgages, medical bills and other miscellaneous debts. For many, bankruptcy meant wiping out this debt, including debt accumulated by credit cards.

But it’s not just those filing for bankruptcies who are trying to cut their losses. Lenders who got burned by this same phenomenon during the Great Recession are now taking greater efforts to only make loans that will be repaid. This means fewer new accounts and, in some cases, more stringent credit requirements for lower credit limits.

The Good News

Though there is still progress to be made in employment numbers, the hard times have likely made people more resilient for the future. Many Americans were able to clear out all their old debts through bankruptcy and more importantly, some people have learned from their credit card mistakes. Though the economy is improving, credit card debt has not increased significantly, suggesting that Americans may be changing their mentality towards debt.

If you are feeling overwhelmed by debt, and would like to discuss your options for a chance to start over, contact bankruptcy attorney Anthony DeLuca at (702) 252-4673 for a free consultation.

If you liked this post, you might also like:

Repairing Your Credit Score After Bankruptcy

Will I Lose My Tax Refund If I File Bankruptcy?

Bankruptcy Filings Low For Second Straight Year