When Banks Fail to Comply: Don’t Repay Discharged Debt

Bankruptcy is set up to allow debtors a reprieve from bills that they are unable to pay. The financial scrutiny they face is intense— every bill, bank account, asset, possession and debt is examined thoroughly. Then, if the courts decided that an individual should be granted a discharge, they are allowed what essentially amounts to a fresh start. The debtors take a hit on their credit report that will be visible for almost a decade, but in exchange, most debts are wiped out or restructured.

How financial institutions are undermining bankruptcy

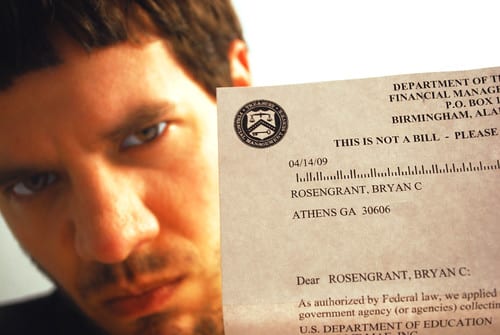

Instead of complying with bankruptcy courts’ decision to render discharged debts void, some of the nation’s largest banks are simply ignoring the rulings. After a borrower has discharged debts through bankruptcy, financial institutions are obligated to update the information they pass on to credit reporting agencies. In some cases, they are simply failing to do so. As a debt collection tactic, some banks are failing to remove the label of “past due” or “charged off” from debts that are no longer owed.

Are borrowers obligated to pay?

Borrowers are, under no circumstance, required to repay any debts that were successfully discharged in a bankruptcy. Unfortunately, in these situations, debtors feel obligated to repay debts they have no legal responsibility to pay. Because their credit reports are already flawed due to the past bankruptcy, they feel pressured into paying in order to improve their credit scores. If they don’t pay, negative marks may remain on their credit reports, preventing them from obtaining certain loans or mortgages.

Why file for bankruptcy?

In most cases, financial institutions to comply with bankruptcy rulings, as it is both unethical and illegal if they fail to do so. If you choose to file for bankruptcy, you can get a fresh start on your finances. On a temporary basis, this ensures that creditors cannot legally garnish your wages, drain your bank account, or take hold of your car, home, or other possessions. On a long-term basis, it gives you the chance to rebuild your life and get back on the road to financial freedom.

If you are considering filing for chapter 7 or chapter 13 bankruptcy in Las Vegas, consult with DeLuca & Associates. Addressing your concerns about bankruptcy with a seasoned bankruptcy lawyer will help you determine the best avenue for your financial future. For more information, call (702) 252 -4673.