Bankruptcy Discrimination: Is it Legal?

Filing for bankruptcy can provide you with a fresh start, but sometimes it can be difficult to know which steps to take after everything is said and done. For example, some businesses or organizations may require you to prove that you are a responsible consumer before conducting any business with you. Here is a look at which organizations are legally prohibited from discriminating against those who have filed for bankruptcy.

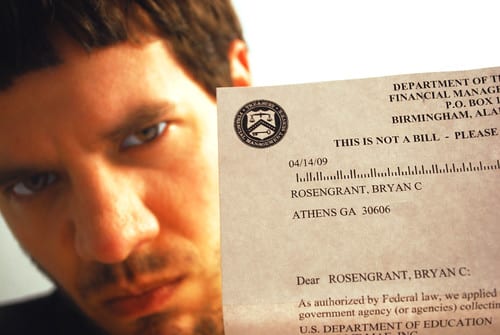

Government Agencies Cannot Legally Discriminate Against Bankruptcy Filings

Specifically, representatives of the government are not allowed to deny, revoke, suspend, or refuse to renew a license, charter, permit, franchise, or other grant just because you’ve filed for a bankruptcy. This means that government agencies cannot deny you public benefits, a driver’s license, or exclude you from public housing and home financing programs. If you are or were a student, your college transcripts cannot be withheld nor can you be excluded from student loan opportunities. Business-owners who file for bankruptcy cannot be denied government contracts or licenses (such as a state liquor license or other necessary license).

In essence, a bankruptcy can discharge any government-related debt (including tax debts in many cases). Once this debt has been discharged, you are to be treated like any other citizen.

Private Entities May Include Bankruptcy History in Their Criteria

Private companies are not beholden to the same set of laws summarized above. While your employer cannot fire you because of a bankruptcy filing, they can refuse to hire you. Private entities can also deny you rental housing, withhold a college transcript, or deny loans. This can make life after bankruptcy difficult. For instance, a potential landlord can legally turn down your rental agreement once they’ve found a bankruptcy in your credit history.

What Can I Do To Minimize The Impact of the Private Sector?

In the short-term, you can often overcome the hesitancy of potential landlords by crafting a renter’s resume that shows your positive history of renting and employment, offering to have a cosigner, or even pay several months of rent up front. You can also take steps to improve your credit score such as:

- Opting for a reaffirmation agreement on at least part of your debt during bankruptcy

- Opening a secured credit card

- Becoming an Authorized User on an established credit account

- Checking your credit report regularly for errors

As you begin to make payments on time and rebuild your credit, your financial history will look much more appealing to businesses, lenders, and other entities, and your bankruptcy will be less of a factor to all parties involved.

If you are considering filing for bankruptcy, and would like to know more about the process, contact DeLuca & Associates at (702) 252-4673 to schedule a free consultation today.

If you liked this post, you might also like:

Repairing Your Credit Score After Bankruptcy

Can You File Bankruptcy On IRS Debt?

5 Politicians Who Declared Bankruptcy