Can I File For Bankruptcy After Moving To A New State?

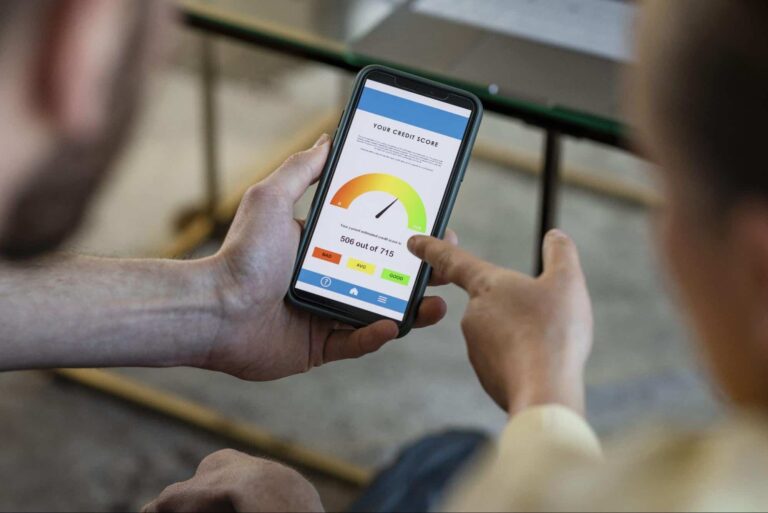

Bankruptcy proceedings can be a complicated process to navigate. If you’re moving forward with a personal bankruptcy case, you’re not alone. In 2021, the U.S. Courts System recorded 413,616 Americans filing for bankruptcy. Filing a claim can be overwhelming in itself. But what do you do when your bankruptcy case occurs during a move between…