5 Tips for Rebuilding Your Credit After Bankruptcy

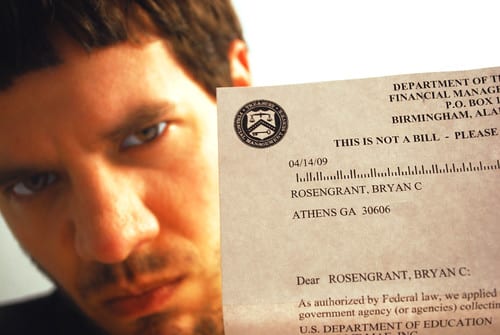

Filing for bankruptcy can cause even the highest of credit scores to plummet deep into the subprime lending zone. Whether you start in the high 700s or in the low 600s, a bankruptcy will most likely drop your credit rating well below 550. Being in this “subprime” lending zone means that an individual will have difficulty obtaining loans, if they can obtain loans at all. Often, after being turned away from traditional lenders, these individuals are forced to take out loans at a high interest rate. High interest rates can translate into tens of thousands of dollars worth of extra expenses over the life of some loans.

This is why it is important for individuals to begin to rebuild their credit immediately after filing for bankruptcy. Here are a few ways to begin raising your credit rating after filing for a bankruptcy.

Open a new checking and savings account

An essential first step to getting finances back on track is opening up a new checking and savings account. This will give you a fresh slate to work with and show financial institutions that you are committed to restoring financial stability.

Keep tabs on your credit score

While you can get your credit report for free once a year at annualcreditreport.com, it’s a good idea to check your credit score far more often than once a year. Consider signing up for a site like Credit Karma, so you can check your credit as often as you would like for free. You can even keep tabs on how day-to-day activity affects your score.

Budget and pay bills on time

Create a budget for the essentials, and stick to it. Sit down and figure out how much money you need to get by every month, and try to eliminate expenses that can be considered unnecessary or frivolous. Always pay bills on time, as missing payments can lead to derogatory marks on your credit report.

Apply for a secured credit card

Getting a credit card may seem like a bad idea, considering you may have just pulled yourself out of a financial jam caused by credit card use. In reality, acquiring a low-limit secured credit card is one of the best things you can do to raise your credit rating. On one hand, secured credit cards almost always have a small annual fee and sometimes require a deposit. On the other hand, however, they are easy to get with any credit rating, making them ideal for individuals with low scores.

Get a retail or gas credit card

Both retail and gas credit cards help you turn necessary expenses into a way to build credit. If you find yourself filling up at the pump or visiting Walmart multiple times per month, why use it to your advantage? Make sure to avoid getting charge cards from retail stores that are out of your price range, or that will tempt you to go on a shopping spree.

Rebuilding your credit will take a lot of persistence and patience. After 12 to 24 months, you should see an increase in your credit score. At this time, you can consider applying for an unsecured credit card to raise your score even further.

Filing for bankruptcy, and then regaining your financial footing afterword is a long and difficult journey. If you find yourself in need of a bankruptcy attorney in Las Vegas to help make the process of filing as painless as possible, contact DeLuca & Associates today at (702) 252-4673.