3 Common Questions about Filing for Bankruptcy

Deciding whether to file for bankruptcy is difficult enough, but on top of that, the details for filing can be confusing. It is extremely common to have questions when considering filing for Chapter 7 or Chapter 13 bankruptcy. Here are the answers to some of the most commonly asked bankruptcy questions.

Will bankruptcy eliminate all of my debts?

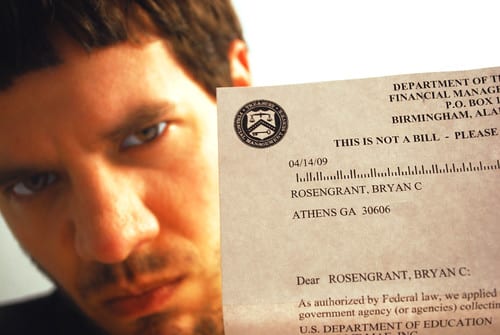

It ultimately depends on your unique situation. To eliminate credit card, medical debt, deficiencies resulting from a repossession or foreclosure, and/or other unsecured debt, bankruptcy can be a viable option. At the end of Chapter 7 bankruptcy, the debt is discharged. But in Chapter 13 bankruptcies, debtors must pay back all or a portion of their debts through a repayment plan. Certain types of debt cannot be cancelled in bankruptcy, such as child support, spousal support, certain tax debts, and, almost always, student loans.

Can I keep my property if I file for bankruptcy?

In Chapter 13 bankruptcy, you can keep your property, assuming you adequately keep up with the required payments for your repayment plan. However, in Chapter 7 bankruptcy, you are asking the bankruptcy court to forgive all or most of your debts without repayment. Thus, the bankruptcy trustee in these cases can seize nonexempt property in exchange for the discharge of debt.

Will bankruptcy help me avoid foreclosure?

In Chapter 7 bankruptcy, it is possible for your home to be sold by a bankruptcy trustee to repay unsecured creditors. Chapter 13 bankruptcy, on the other hand, can be a good option to save your house from foreclosure. In Chapter 13 bankruptcy, you can pay off a mortgage “arrearage” (late, unpaid payments) over the length of an approved repayment plan. If your only concern is saving your home, consider all other alternatives before resorting to bankruptcy. It is possible to negotiate with your lender or get assistance from the government in modifying your loan terms.

Many people struggle over the decision to file for bankruptcy, so you are most certainly not alone. Once you gather all the necessary information and put in understandable terms, bankruptcy need not be as daunting a concept as you once thought. Consider consulting a bankruptcy lawyer in Las Vegas to address more of your questions and concerns.